Get to Know the Income Tax Benefits of NEW Qualified Opportunity Zones

In December of 2017, the U.S. Congress established the Qualified Opportunity Zone (“QOZ”) program, designed to help economically-distressed communities where new investments, under certain conditions, may be eligible to generate preferential tax treatment for investors. Investments made in these designated QOZs through a qualified legal entity referred to as Qualified Opportunity Fund (“QOF”) are intended to provide much-needed new investment and capital into economically depressed communities throughout the United States and Puerto Rico. In short, the QOZ program is an economic development tool designed to spur economic development, revitalize communities in need, and create jobs in distressed communities by attracting new investments in exchange for select income tax benefits.

In general, here is how the QOZ program operates. If an investor disposes of assets (e.g., stocks, real estate, an operating business), on or after Dec. 22, 2017, which triggers taxation of capital gains to the investor, then such investor may seek to utilize the QOZ program. The investor can either create or locate a QOF to invest a portion of its transaction proceeds (e.g., cash) within 180 days of the divestment (sale) transaction date. Once capitalized, the QOF must, in turn, invest a certain minimum amount of its assets (directly or indirectly) into an operational business or real property located in a QOZ. The QOF oversees and manages the investment in the QOZ until the QOF decides to divest from the QOZ investment at a future date. In exchange for this QOZ investment, the QOF receives certain income tax benefits that it passes along and up-the-chain to its owners and investors.

As you can imagine, the rules and regulations governing QOZs and QOFs are complicated and require detailed analysis; the previous paragraph is a rather simple summary of a QOZ transaction. Below is a list of some very important highlights to keep in mind when considering an investment using the QOZ program.

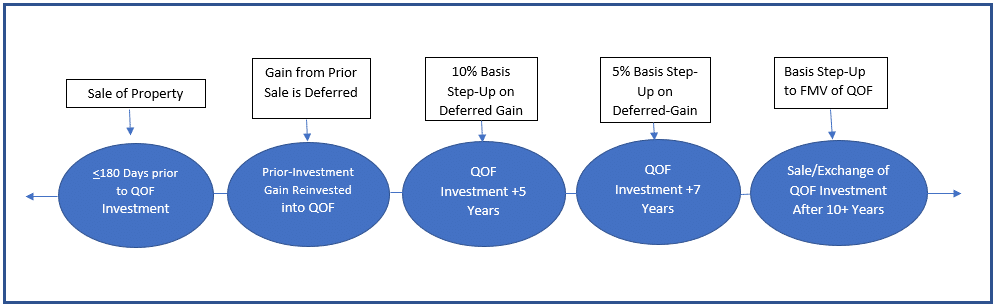

The QOZ program is designed to provide three (3) tiers of income tax benefits to investors:

The investors can defer income taxation on prior capital gains that are invested in a QOF until the earlier of December 31, 2026 and the date on which the investment in a QOF is relinquished (known as the capital gain deferral piece).

If the investor holds the investment in the QOF for longer than 5 years then there is a 10% bonus exclusion of the deferred income taxation on the prior capital gains. If the investor holds the investment in the QOF for longer than 7 years then the bonus exclusion bumps up to 15% (known as the tax basis step-up piece).

If the investor holds the investment in the QOF for no less than 10 years, then the investor is eligible to liquidate or cash-out from the QOF free of income taxation on any new tax gains generated from appreciation of this QOF investment (known as the non-recognition of new taxation piece).

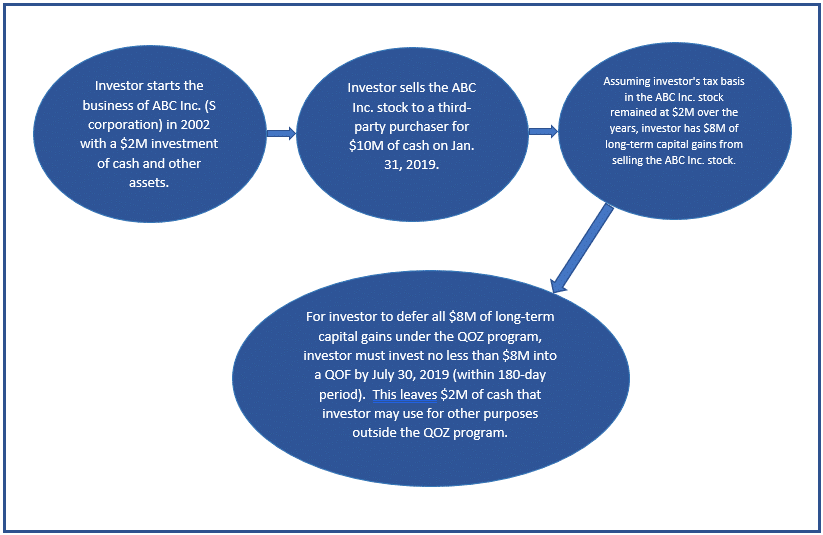

Only capital gains (although both long-term and short-term) are eligible for deferral under the QOZ program. Ordinary income (non-capital gains) is not eligible for deferral under the QOZ program. However, all capital gains are eligible for roll-over into a QOF. The QOZ program is not limited to gains from real estate, stocks or any specific asset or transaction, and a pot of various sources of capital gains can be used to invest in a QOF. In other words, an investor can dispose of many different assets in various transactions and trigger capital gains from these items, and then invest all (or a portion of) these capital gains into a QOF to receive the income tax benefits.

An investor can defer payment of capital gain taxation to the latest date of Dec. 31, 2026, so long as such prior capital gains are invested into a QOF within 180 days of the divestment (sale) transaction that triggered the tax gain. The S. Internal Revenue Service (“IRS”) clarified that the clock for the 180-day period for investing the capital gains in the QOF begins for most taxpayers on the date the capital gains would be recognized for U.S. federal income tax purposes. For individuals, this rule means the date on which the dispositions of assets trigger capital gains taxation. For partnerships, the 180-day period begins to run on the date the partnership disposes of assets triggering capital gains taxation. But, if the partnership does not reinvest its capital gains in a QOF, then the partners may reinvest their allocable share capital gains, and the 180-day period for each partner begins on the last day of the partnership’s tax year in which such disposition of assets occurred. This partnership rule also applies to S corporations (but not C corporations).

Only the amount of the capital gains must be invested into a QOF to defer all the income taxation related to them. There is no requirement that all cash received by an investor from the disposition of assets must be reinvested in a QOF to receive the income tax benefits; just an amount of assets (e.g., cash) equal to the amount of the prior capital gains.

Think of a QOF as an investment vehicle, whether a partnership or a corporation, that acts as the funnel for the various investors to collect money and other assets to invest it into the QOZs. The QOF can be a new or existing entity, and could be an entity created by the investor solely to invest its money and assets. A QOF becomes qualified with the IRS by self-certifying that it is a QOF and filing IRS Form 8996 (Qualified Opportunity Fund) with its federal income tax return. For example, a QOF could be a newly-formed Florida limited liability company that is organized by the investor, capitalized by the investor and at least one other person, taxed as a “partnership” for U.S. federal income tax purposes, and invests its money by acquiring QOZ property.

The QOF must acquire, own and hold QOZ property to generate the income tax benefits. However, the QOF is not required to utilize all its cash and assets to acquire, own and hold QOZ property, but there is a minimum threshold that must be satisfied by the QOF. Also, there are strict limitations and rigorous requirements surrounding the QOZ property acquired, owned and held by the QOF.

Current operating income generated from an investment in a QOF is subject to income taxation, and does not receive any special tax exceptions or tax exclusions.

An investor does not need to live, work or have a business in a QOZ to receive the income tax benefits. All the investor must do is invest prior capital gains into a QOF and elect to defer the taxation on such capital gains pursuant to the U.S. federal tax code.

For an investor to receive the full array of QOF taxation benefits, the latest date (according to the current S. federal tax code requirements) by which capital gains must be invested into a QOF is Dec. 31, 2019.

For an investment to comply with and satisfy the requirements of the QOZ program, the investment must be an equity ownership interest in the QOF. Loaning money to a QOF (i.e., debt instruments) is not an eligible investment for purposes of the QOZ program.

The income tax benefits generated by the QOZ program are not mutually exclusive of other tax benefits under the S. federal tax code, such as New Markets Tax Credits (NMTCs), Low-Income Housing Tax Credits (LIHTCs), and section 1031 like-kind exchanges (assuming some capital gains are triggered by the transaction). The QOZ program could be combined with other programs.

The QOZs were designated by the Governor of Florida prior to March of 2018, and QOZs represent specific “census tracts” located within low-income communities. Here is a website link to a map showing the various QOZs within the State of Florida:

https://deolmsgis.maps.arcgis.com/apps/webappviewer/index.html?id=4e768ad410c84a32ac9aa91035cc2375

As you can see, the rules and regulations governing QOZs and QOFs are complicated and require very detailed analysis. All facts and circumstances should be taken into consideration when considering, and prior to making, an investment into a QOF using the QOZ program. Should you have any questions regarding the QOZ program, please feel free to contact Nathaniel Dutt, Esq. at ndutt@SLLaw.com or Jordan Horowitz, Esq. at jhorowitz@SLLaw.com, or either at 407-581-9800.